Welcome to The Distillate! Petroleum industry news for informed decisions for Tuesday May 13th, 2025. A product of Standard Petroleum Logistics (an actual fuel distributor). Paid subscribers get access to news that is only available to industry insiders. Want to know what’s really going on with in the oil industry and save money? You can do that, with a subscription to The Distillate.

Markets are up again this morning on optimism and easing of trade tantrums.

Road check! The Commercial Vehicle Safety Alliance’s International Road Check safety blitz for commercial haulers has begun. Law enforcement personnel are focused on hours-of-service (sorry y’all, no loose leaf logbooks), tire tread and inflation, brake systems and security of cargo. (We recommend slapping your cargo and stating “that’s not going anywhere” for extra protection). The blitz runs through this week.

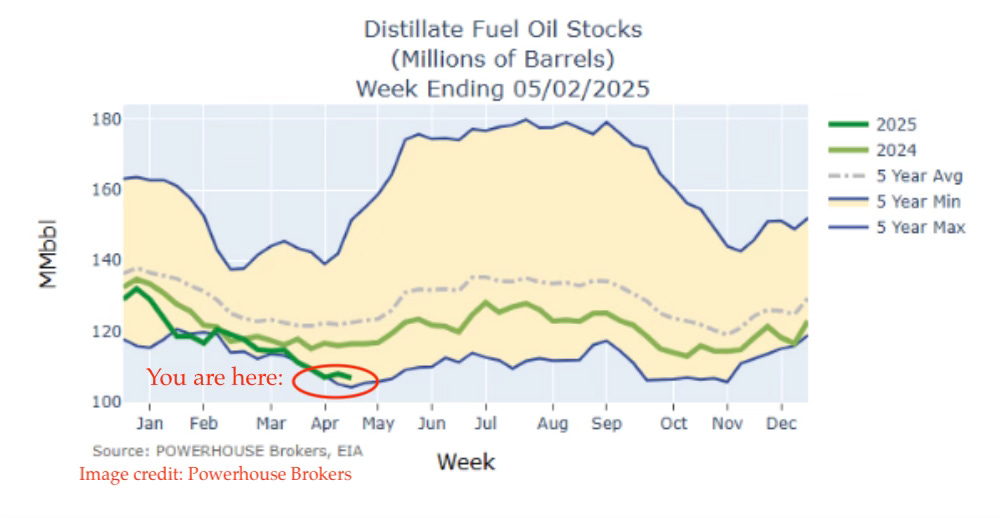

All eyes on diesel. Strange things are brewing in the middle of the barrel. China tariff drama and concerns of global economic slowing have dragged prices down. Meanwhile, market dynamics have pulled inventory down, leaving us hovering at the bottom end of the five-year range for months. Low inventory should mean higher prices, but that has not been the case. The expiration of the biodiesel blender tax credit has taken millions of gallons of renewable and biodiesel out of the mix, drawing inventories down farther. At the terminal level we are still seeing sufficient supply – but only because it is May. The eastern seaboard needs much higher operating inventory to support the heat season. For our resellers and retailers – inventories this low are susceptible to major price shocks and supply issues. Manage your inventory conservatively.

Small operators beware. The super-brands are coming for your market share. Eastern convenience chain Wawa has announced a five-year plan that includes some 700 new locations. The chain known by consumers for cheap gas and sub sandwiches and known by industry insiders for owning their own fuel barge and sketchy ethanol blending opened three stores in the Midwest and two in Georgia just this month. The chain takes huge bites out of market share wherever it lands but consumers beware: evidence is mounting that Wawa is increasing the amount of ethanol blended into their gasoline to the full amount allowable by law, exploiting a tolerance for profit. This will drop the price at the pump, but will burn hot and reduce your fuel economy. You buy more, they sell more, they profit more.

Keep reading with a 7-day free trial

Subscribe to The Distillate to keep reading this post and get 7 days of free access to the full post archives.